What is the Increase to Guideline Hourly Rates in 2026?

By Sean Linley, Senior Costs Draftsman

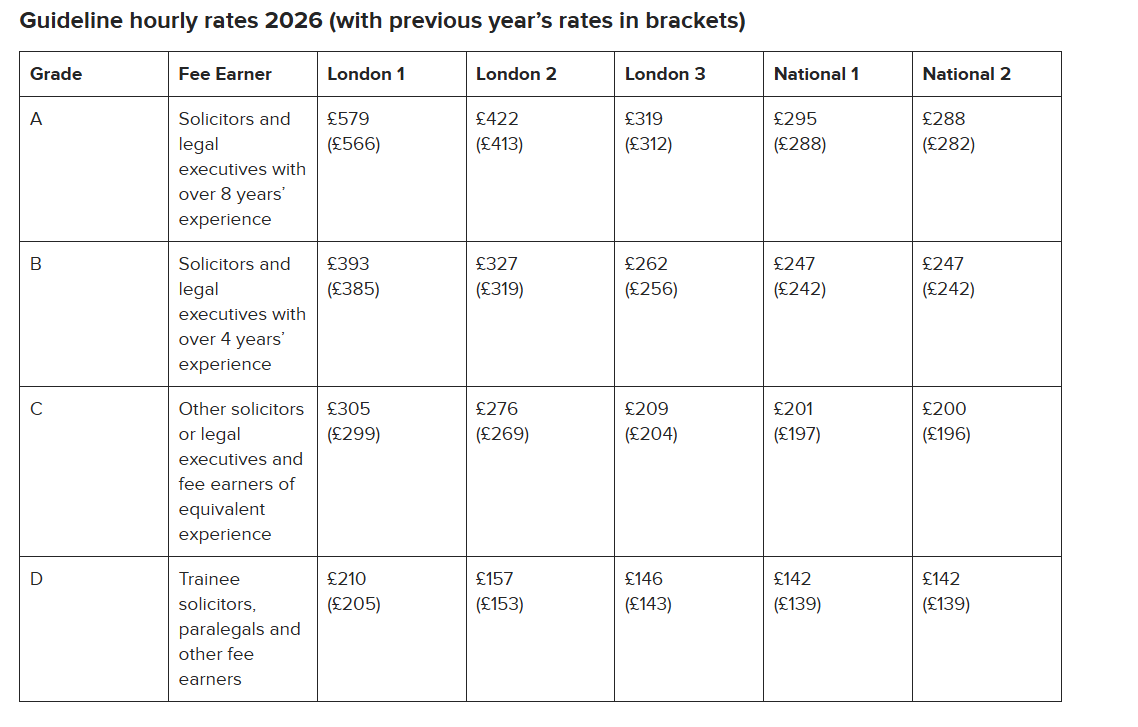

The Guideline Hourly Rates have increased in line with SPPI (inflation) from 1 January 2026. The new rates are set out below (with the previous rates detailed at the bottom of this article). Practitioners should use the opportunity to review their retainer rates for both new and existing matters. If you’re unsure about hourly rates or would just like some general advice then do not hesitate to get in touch. Practitioners should take care to make sure that their retainers allow an increase to be made and that the correct notification is given.

The increase in 2026 marks the third year running that the Guideline Hourly Rates have increased and sees an uplift of around 2.3% on the 2025 rates. It also marks the first time that Grade C has broken the £200 mark across all geographical regions.

Although no public notice was given of the increase to the GHRs this year, it was expected. Previously the Master of the Rolls, Sir Geoffrey Vos had approved recommendations from the Civil Justice Council in 2023 for hourly rates to be subject to yearly reviews linked to the general SPPI on 1 January each year. It was also recommend that detailed reviews should take place every 5 years. This would mean the next detailed review would be around 2028-9.

In a news update on the Judicary website, Sir Geoffrey Vos said that:

“In 2022, I requested that the Civil Justice Council take a strategic look at costs.

“I have now implemented the Council’s recommendation to update guideline hourly rates for inflation.

“In January 2024, figures were uplifted using the service producer price inflation (SPPI) figures from Q1 2022 – Q1 2023 inclusive. This amounted to a 6.66% increase.

“These figures are now to be updated using more recent SPPI values, to cover up to Q1 2025.

“The uplift from the 2025 rates to the new 2026 rates amounts to an increase of 2.28%.

“I would also like to mention that the Civil Justice Council has established a working group to examine whether guideline hourly rates can be produced for either or both of counsels’ fees and a new top rate for complex commercial work. I look forward to receiving the Civil Justice Council’s interim report on these issues later this year.”

As Vos clarifies in his statement work remains underway on the establishment of Guideline Hourly Rates for Counsel and consideration remains as to the introduction of a new complex commercial work rate which would apply to the work itself rather than location. These could well be in place for 2027.

You can read our article on the previous Guideline Rates here.

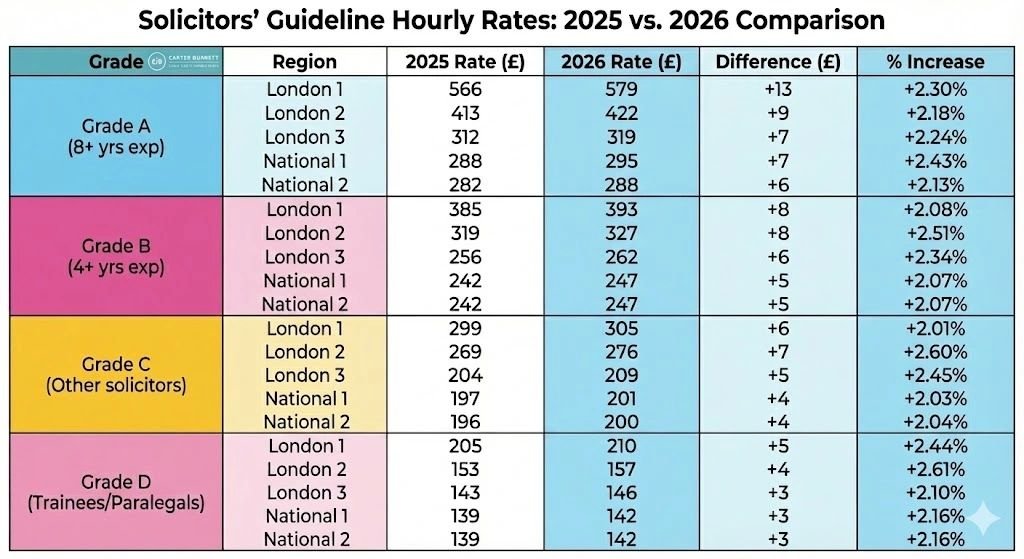

Our table showing the change in Guideline Hourly Rates from 1 January 2026 is below:

Visit the Government website to learn more about the new Guideline Hourly Rates.

What is the impact on new and existing matters?

If you are planning to increase your hourly rates, make sure your retainer reflects this and that clients are properly notified for existing cases. If you’re unsure then seek specialist advice.

Although the new Guideline Hourly Rates are not retrospective in the strict sense, they reflect historic increasing inflation and may therefore aid arguments around justifications for hourly rates claimed to-date which exceed the previous GHRs.

For those already operating above Guideline Hourly Rates then you may wish to give consideration may as to whether those rates also need to be reviewed. For example, if the current retainer rates are 20 per cent above the previous GHRs then it may be appropriate to consider increasing the rates to reflect the same margin as against the increased GHRs. Commercial considerations are required.

Practitioners should also heed the warning of Mr Justice Andrew Baker in the case of CRF I Limited v Banco Nacional De Cuba & Anor [2025] EWHC 3279 (Comm). He rejected an argument by the receiving party that GHRs were outdated:

“I do not accept the submission that guideline rates in any general sense are somewhat out of date. They are, to the contrary, regularly updated. They are recognised to be guideline rates for what should be a reasonable recovery, and those setting the guideline rates are well aware that often parties are willing to agree to pay their own solicitors at rates above that, even in circumstances where it could not justifiably be said that the particular matter for which those hourly rates were being charged justified a very substantial uplift.”

It remains that where hourly rates exceeding Guideline Hourly Rates are claimed clear and compelling justification will be required.

Does the new rate limit what Receiving Parties can recover?

In principle, the new GHRs will see the recoverable rates and solicitor-own-client rates increase. These rates, however, remain broad approximations and are only intended to be a starting point for summary assessment. This means that in appropriate circumstances the Court will allow a claim for an hourly rate exceeding Guideline Hourly Rates.

Paying Parties are likely to argue that the reviews (particularly given there have been rises for three years running) will mean that the Guideline Hourly Rates are more reliable when it comes to assessment and, as a consequence, there should be fewer departures from them.

The change does not alter the position that clear and compelling reasons are required to recover rates exceeding guidelines. This means for higher-value and more complex cases the GHRs are unlikely to be appropriate.

It should be stressed that the increase in GHRs is not automatic and you will remain limited to the hourly rates agreed with the client, as per the indemnity principle. This is why it is important to review the rates currently agreed and to notify the client if it is considered reasonable to update the same.

How will the new GHR affect claims for Costs?

It will increase the starting point for Costs claims which may in turn see the hourly rate recovery increase. It’s a useful tool in Costs negotiations and will be taken into account by the Court at any assessment.

It may have practical implications where a Costs Budget has already been set on the basis of existing hourly rates and will also impact the preparation of any current Costs Budgets, if hourly rates are to be revised by Practitioners.

For those operating under Fixed Costs then the increase will see practitioners afforded less time to undertake work because whilst the GHRs have increased, FRC have not though a review of FRC is expected in 2026 which may include inflationary uprating, though any changes are unlikely until the second half of the year at the earliest.

If you need some help or assistance in light of the increase to the Guideline Hourly Rates (GHRs), get in touch e-mail info[at]carterburnett.co.uk or call 01482 534567 for a friendly chat - we'll be happy to give you guidance or advice.