Fixed Recoverable Costs and Counsel Fees

By Sean Linley, Senior Costs Draftsman

Sir Rupert Jackson’s Review of Civil Litigation Costs: Supplemental Report Fixed Recoverable Costs is now 9 years old, having been published in 2017. Despite the passage of time, in the vacuum of authorities and precedents it remains a useful reference point behind the intentions of the post October 2023 Fixed Costs landscape.

One common issue on Fixed Recoverable Costs cases centres on the recovery of Counsel fees in Fast Track and Intermediate Track matters. Sir Rupert Jackson, addressed this in his report but one of the most biting remarks was made when setting out how Fast Track Fixed Recoverable Costs would work (Bands 1-3), at 5.10 of his report he states:

“It is for solicitors to decide whether to do items of pre-trial work themselves or to instruct Counsel”

Whilst this is not the complete picture or story, it would be remiss to ignore the warning proffered by the founding father of Fixed Costs reforms.

It will be familiar to Practitioners that fixed recoverable costs do not generally cover the extent of the work required to conduct a claim so it is prescient to limit shortfalls. One way is to be wary of incurring expenses that may not be recoverable between the parties. Afterall if Counsel’s input proves irrecoverable then who is paying? This is why it is vital to understand when and where Counsel fees are recoverable within the confines of the post October 2023 landscape.

As Sir Jackson alludes to there will be circumstances and decisions made where it must be borne in mind that the instruction of Counsel may ultimately see such fees form part of the Fixed Recoverable Costs sums themselves.

This blog looks at what Counsel fees are recoverable and the core principles around them. What it does not do is delve into the issue as to who a ‘Specialist Legal Representative’ is. It is clear though that the sums for Counsel could prospectively be attributed to a specialist lawyer or trial advocate.

Underlying Principles

The Court of Appeal decision in Aldred v Cham encapsulated the question of what do Fixed Recoverable Costs actually cover? It is a pertinent one. If the sums set out in Practice Direction 45 already cover an aspect of work why should a party be able to circumvent that by sub-contracting work and in essence get paid twice? Of course this is a trite and over simplistic view but it is still a question that requires an answer.

There are two distinct and separate issues on Counsel fees:

a. Fees which are prescribed within the rules.

b. Fees which are not prescribed in the rules.

Aldred is oft quoted by paying parties as impeachable but a closer examination will show that whilst it does establish a high threshold it is not insurmountable and indeed it is worth reflecting that the post October 2023 FRC rules saw a rule change brought about directly as a lasting consequence of the Court of Appeal’s judgment.

In Aldred it was made clear that non-prescribed Counsel fees may be recoverable where CPR 45x.29I was engaged. In short if the disbursement was reasonably incurred due to a particular feature of the dispute then it would, in principle, be recoverable. Post October 2023, these provisions are now wider covering disbursements incurred “due to a particular feature of the dispute or any requirement of these rules”.

The bottom line is that instructing Counsel outside of the prescribed rules will inevitably carry risk around recovery unless it can be established such fees are incurred because of a particular feature of a dispute or requirement of the rules. The question of what is a particular feature of a dispute would take up another lengthy blog so to put it concisely recovering fees outside the prescribed work for Counsel will invariably bring risks of a costs dispute.

The other case worth reflecting is Santiago v MIB [2023] EWCA Civ 838 which saw the Court of Appeal rule in favour of the principle of recovery of interpreter fees in fixed costs matters, breaking from the approach adopted in Aldred (in the writer’s views correctly). The Court was clear that costs have to be viewed through the prism of access to justice. Whilst it does not directly address issues around Counsel fees it highlights that the Court has the necessary discretion to allow costs which may not be explicitly provided within the rules.

What Counsel fees are prescribed on the Fast Track?

Sir Rupert Jackson’s earlier remarks permeate across the Fast Track. The express allowances for Counsel in Fast Track FRC are extremely limited. It’ll be observed that there is no express pre-issue allowance. So issue your case, ask questions later.

The Fast Track allowances are summarised below:

Post Issue Advice in writing or in conference (Complexity Band 4 only) - £1,000 plus VAT

Drafting a Statement of Case (Complexity Band 4 only) - £500 plus VAT

Advice Obtained in Claims started under the RTA or EL/PL Protocol (provided for in the relevant protocol or where the Claimant is a child) - £150 plus VAT

Advocacy Fees - £619 to £2,994 plus VAT (variable on claim value and complexity band)

The scope of prescribed Counsel fees are very limited in the Fast Track and for the fees on Complexity Band 4 only the Court can disallow the fees if the use of Counsel is not justified (CPR 45.46). Further, the court will order payment for only one advice in writing or in conference unless any additional input can again be justified. So you may have to be prepared to doubly justify!

The sense is that the view of the rule makers is that the use of Counsel in Fast Track matters ought to be very limited, if at all. There’s scant authority or examples of what justification may look like. The only real certainty is that the scope of judicial discretion is wide and decisions remain inconsistent. What is justified to one Judge, may not be justified to another. It’s effectively like drawing straws.

As others have remarked there is a growing consensus that the promised certainty that FRC would bring has simply not materialised.

What Counsel fees are prescribed on the Intermediate Track?

There is a wider allowance for Counsel fees and involvement under the Intermediate Track. However, there remains no express pre-issue allowance.

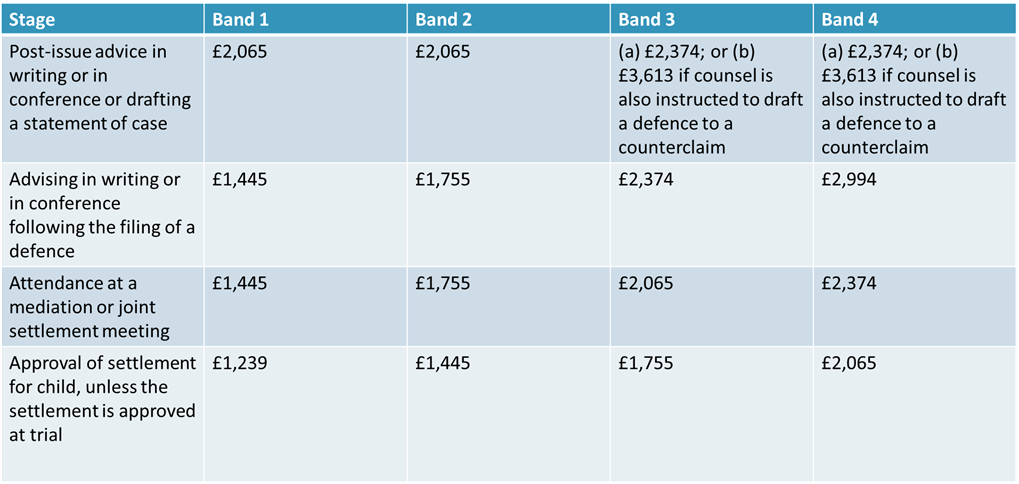

The image below details the scope for Counsel fees on the Intermediate Track:

One point to note is that the Approval of settlement for a child is not expressly stated to be Counsel. I have included this here as it is an aspect of work Counsel is commonly retained to do. But for clarity the figures above would be to cover all approval work, solicitor and Counsel.

Again, as with the prescribed figures in the Fast Track, the sums for post-issue advice, drafting a statement of case, post-Defence advice and attendance at a JSM/Mediation all require the use of Counsel to be justified (CPR 45.50(4)). There is no express scope within the Intermediate Track rules to allow a claim for more than one advice (if justified) beyond those set out in PD 45. This is a contrast to the Fast Track provisions which at least clearly allow a case to be made for more than one advice (notwithstanding that the IT sums allow for post-issue and post-defence advice) .

So even on the Intermediate Track there is no guaranteed or clear certainty that even the fixed sums for Counsel would be recovered. A Paying Party could well try to argue that such input was not justified.

What is noteworthy though is that fixed sums are prescribed for all Complexity Bands signalling that an argument that a claim is not complex cannot be the sole determining factor as to whether the use of Counsel is justified or not.

What do I do if there is a dispute?

The snappily titled Section X sets out the procedure governing Fixed Costs disputes. It is designed to be a paper exercise and will see the Court determine any disputes arising from a Fixed Costs claim. The costs of the procedure are fixed (though regular readers will know that there is more to this).

The point is where there is a dispute you can have recourse to court.

We regularly deal with such disputes and can do so either on a case by case basis or as part of our unlimited fixed costs retainer. More details on that may be found here. We have been on the coalface of these arguments.

Key Takeaways

The key is to conduct cases which are prospectively Fixed Recoverable Costs open eyed. Be prepared for prospective challenges and be alert where there is a risk fees may not be recovered. For some it may well be a commercial decision to outsource certain aspects of work to Counsel and that’s perfectly fine so long as you are aware where such fees may not ultimately be recoverable between the parties. Compromises may have to be made.

Further, establish good strong working relationships with Counsel and Chambers. This is paramount to ensuring that financial risks can be limited and / or shared. It’ll also be beneficial to ensuring any retained Barrister is prepared to work within the confines of the FRC regime. If they are not it allows informed decisions to be undertaken.

It’s also evident that the conduct of litigation must now be varied to be economically viable. An awareness of costs is vital, particularly what regime and what may / may not be ultimately recovered. This is the reality of the post October 2023 landscape.

Fundamentally it is for Practitioners to decide how they wish to run their cases and when it comes to the use of Counsel this has to be done with complete clarity as to the possible implications. Those who best navigate the FRC regime will be those alive to the pitfalls and perils of it.

Do you want to discuss matters relating to disbursement recovery or simply costs matters generally? We are always happy to have a chat and provide a view or advice on strategy, tactics and/or approach. Should you want to discuss this or any other issues, then you can give us a call on 01482 534 567 or email info@carterburnett.co.uk.