Application Costs Restricted to Fixed Costs on Intermediate Track

A reminder, if it was ever needed that application costs under Fast Track and Intermediate Track cases are fixed absent exceptional circumstances. You can read our previous blog on this subject here.

In Mazur & Anor v Charles Russell Speechlys LLP [2025] EWHC 2341 (KB) (16 September 2025) the court overturned a costs order of £10,653 and restricted recoverable costs to the fixed costs set out under Practice Direction 45, Table 1.

The court considered the awarding of costs relating to an application to lift a stay in the proceedings and as to arguments pertaining to the Legal Services Act. In short, the court held that the initial decision had been wrong to conclude that the point around LSA had been lost but accepted that the application to lift the stay would have been granted. The wider implications around the LSA ruling, specifically as to who is entitled to conduct litigation is addressed in Gordon Exall's blog. This is worth close consideration in its own right. The High Court in essence holding that unqualified employees of a law frim can support a regulated individual in conducting litigation but cannot conduct litigation under supervision of a regulated person. This is likely to have significant impact. Many firms rely on this model of conducting litigation when running low value claims and the sums allowed here for the interim application of just £333 plus VAT sharpens the impact of the LSA point.

From a costs perspective the case is a powerful reminder of the need to always consider what costs are likely to be recoverable when approaching any litigation subject to either the Fast or Intermediate Tracks.

Speed Read

The key points can be summarised as follows:

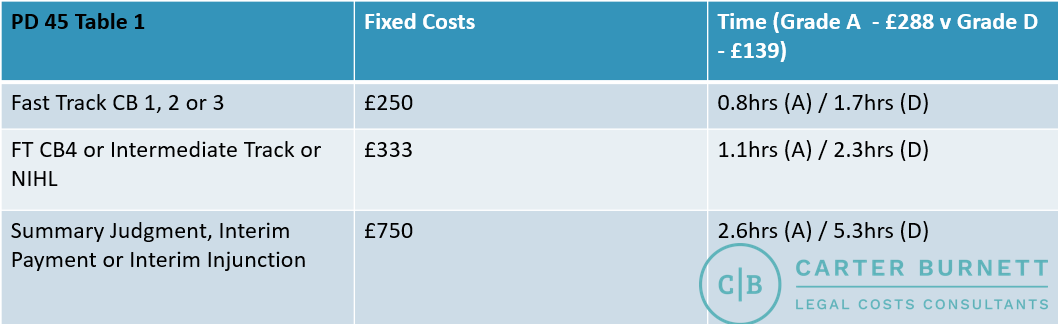

1. Where a pre-action or interim application is made on the Fast or Intermediate Track then the application costs are fixed pursuant to PD 45 Table 1. This is £250 plus VAT for Fast Track Complexity Bands 1 to 3, £333 plus VAT for Fast Track CB4 and the Intermediate Track and £750 plus VAT for summary judgment and/or interim payment and/or interim injunction applications plus court fees. The table below sets the various fees out.

2. The court may summarily assess or order detailed assessment of application costs where there are exceptional circumstances. This is consistent with the Court of Appeal decision of Sharp v Leeds City Council [2017] EWCA Civ 33 (01 February 2017).

3. The fact that the application was heard before allocation is irrelevant, if the claim is one which is suitable for the Fast or Intermediate Track then the application costs will be fixed absent exceptional circumstances. Here the case had been provisionally allocated to the Intermediate Track and was formally allocated at the end of the application hearing.

4. CPR 45.63(2) requires a party who intends to claim fixed costs or disbursements to file and serve a Precedent U 24 hours before the hearing. Here the Respondents had not provided any Precedent U instead filing N260s. The court held that the fact that there were documents filed and served in support was enough. As a practice point you should always ensure costs documentation is filed and served either where fixed costs are sought at a hearing or final hearing or where you seek costs to be summarily assessed. There is precedent for the court disallowing costs entirely where no costs documentation/evidence has been provided.

5. The case highlights the need to give careful consideration to the approach to matters that may proceed under the Fast or Intermediate Track and the same should inform the approach to dealing with any applications. For instance making clear to the client the extent to which costs are likely to be recoverable and in arguably looking to have interim applications dealt with on paper wherever possible to save costs.

6. Unqualified fee earners cannot conduct litigation, they can only support regulated individuals in conducting litigation. The High Court held that there was "a clear distinction between persons who are entitled to carry out reserved legal activities and those who are not". Indeed it was observed that it could be a criminal offence for both the qualified and unqualified fee earner if one of their employees carried out reserved legal activity without being entitled to. This has two very clear practical consequences. Firstly, it must surely quell arguments that any claim can be conducted at Grade D and secondly, it raises a legitmate question as to how firms can run low value claims (to inc. fixed costs cases) which significantly rely on more junior involvement to be viable. The High Court stated it would be for the SRA to consider any regulatory intervention in view of the judgment given and recounted the SRA's comments that:

"[...] the key question to ask was whether the person has assumed responsibility for the conduct of the litigation and exercises professional judgment in respect of it. The SRA submitted that a non-authorised employee who assists a solicitor with conduct of litigation, even to a significant degree, by drafting litigation documents and letters, proofing witnesses, or similar functions does not conduct litigation because it is the solicitor who exercises the final professional judgement about how the litigation is to be conducted and takes responsibility for that judgement. That would be different, however, if on a true analysis and focusing on substance not form the non-authorised person was the one responsible for the litigation and exercising professional judgment in respect of it."

Practical Observations

The practical implications of the LSA finding is addressed at Point 6 above but there are also observations which flow from the costs decision to limit costs from £10,653 to £333 plus court fee of £303.

In Sharp v Leeds City Council [2017], Lord Justice Jackson as he then was made the following comment which I think has relevance more broadly in the context of application costs where such costs are fixed:

"It may be that the very limited recovery of expenditure on a PAD application under the fixed costs regime means that such applications are not as effective as a means of sanctioning breach of Protocol disclosure obligations as they should be. If that is made good by appropriate evidence, then it seems to me that some consideration by way of review to the establishment of a more generous, but still fixed, recovery of costs of such applications would be justified."

There is a danger and tension between the economical viability of applications and the deterrent effect they have where costs are set so low. Indeed, it is easy to see more court resource utilised in satellite litigation where a party considers the adverse costs risk so low. A real illustrative point is that on the Fast Track CBs 1-3 the court gets £313, the lawyer gets £250. Even on those FT CB4 or IT matters you're only getting £20 more than the court.

It's hard to suggest that the low fixed application costs will not have an impact on how applications are brought and dealt with. If the court lists a hearing and you have to attend in person then realistically how does £250 or £333 cover preparation of an application, submissions, advice, filing, serving, preparation for the hearing, prospectively travel and then attendance in a hearing. The Grade A guideline rate for Band 1 is currently £288 contrast that to £250 or £333. Do all of the list in just under or just over an hour.

The safety valve of exceptional circumstances still exists but how often that will be engaged (with the high hurdle it has) is not clear. It may well be sensible for parties to push such arguments alongside an N260 highlighting the full extent of the costs incurred but by how much of a margin over fixed costs would be allowed remains to be seen. Indeed, in Mazur the court makes the comment as to the extent to which the costs allowed exceeded the fixed costs sum.

High Court Decision

The High Court found that fixed costs do apply, commenting that:

"72. CPR 45.9 provides that the cost cap can be removed :

"(1) . . . where there are exceptional circumstances making it appropriate to do so.

(2) If the criteria in paragraph (1) are met, the court may—

(a)summarily assess the costs; or

(b)make an order for the costs to be subject to detailed assessment".

73. There was no indication in the judgment, or in the transcript of the hearing, that the learned judge considered that there were "exceptional circumstances" in this case. Moreover, if the "exceptional circumstances" were the arguments about the proper interpretation of the LSA then they would not have justified an award of costs above the cap in any event, for the reasons given above.

74. Accordingly, the learned judge made an error in ordering the Appellants to pay the costs of the application to lift the stay (which was essentially the costs of Counsel) in the sum of £10,653. Rather, the only award that His Honour Judge Simpkiss could have made pursuant to the regime for Intermediate Track cases would have been £333 plus the appropriate court fee of £303."

Interestingly the court rejected an argument by the Appellants that no fixed costs should have been payable because the Respondents had not submitted a Precedent U 24hrs before the hearing as per CPR 45.63(2).

The High Court stated that:

71. The Appellants submitted to this Court that no fixed costs should have been payable at all because the Respondent had not submitted a completed Precedent U form 24 hours before the hearing: this document is called for pursuant to CPR Part 45.63(2). I reject this argument. The Respondent did not use that particular form, but did produce a document that set out their costs. In substance, therefore, the Respondent had complied with the rule, and the Appellants were not disadvantaged in any way by the form in which the costs were presented. Accordingly, the Court did not err in relying on the document provided by the Respondent.

In essence the providing of a schedule of costs was enough to overcome a more draconian sanction of no costs entitlement whatsoever.

Conclusions

The reality is for claims under the Fast & Intermediate Track the starting point will be the fixed costs set out under Practice Direction 45 Table 1 and litigators must be aware of this else there is a risk of a substantial shortfall. If the client is not properly advised then there is also a risk that the client may not be liable for such shortfalls.

The difference here between the costs incurred and allowed here were over £9,000, a sum which could quite feasibly wipe out the applicable fixed costs for the substantive litigation. That is a sobering thought.

The best stance is to be alive to the costs realities and work in tandem with them. Consider how costs can be limited through, where possible, delegation to a more junior fee earner, seeking to have applications dealt with on paper and if not remotely to save travel time. Where costs do greatly exceed the FRC then consider whether exceptional circumstances can be argued to get costs assessed. If you are unsure then seek advice from your trusted costs advisor. Make sure your client is aware of the costs realities and you have their consent to whatever approach is adopted. Some client's may wish to (and have the means to) support incurring costs above and beyond the FRC. It is not lost that this latter point carries all sorts of questions around access to justice and the prospective inequality of arms between some parties. Unfortunately as it stands the rules around costs recovery are what they are and we have to do our best to muddle through until such time that things are changed. The upcoming fixed costs consultation and stocktake may offer the opportunity to revisit this particular aspect of the fixed costs rules.