Interim Applications & Fixed Costs

Posted on 17th October 2023 at 09:22

By Sean Linley, Senior Costs Draftsman

A big shift under October's Fixed Recoverable Costs Reforms is the fixing of costs in all Pre-Action and Interim Applications for claims on the Fast and Intermediate Track (save for those involving Protected Parties which are exempt).

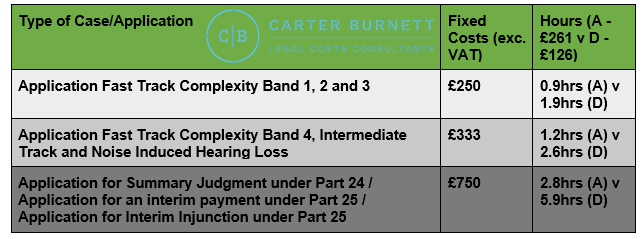

The fixed recoverable costs which apply to pre-action and interim applications on the Fast Track and Intermediate Track under October's reforms are in the table below.

What do the rules say?

It won't be lost that the fixed costs for Fast Track CB1, 2 and 3 are less than the court fee for an application where no other fee is specified - £275! So in this scenario the court gets paid more than the solicitor.

It's also worth noting that Fast Track NIHL cases attract a higher rate of application costs then other Fast Track claims.

And fixed costs applications will mean fixed costs schedules where parties want to seek summary assessment. These at least will be less onerous as there will be no need to set out the time spent where fixed costs are sought. Though it still presents some problems (more on that later).

CPR 45.8 reads as follows (bold our emphasis):

"Where, in any claim to which Section VI [Fast Track], Section VII [Intermediate Track] or Section VIII [NIHL Fast Track] of this Part applies, the court makes an order for the costs of a pre-action or interim application, the costs which a party may be allowed are those set out in Table 1, together with any appropriate court fee"

For clarity the figures in Table 1 are the sums of £250, £333 and £750 plus VAT and shown in the table above in this blog.

Do I get additional disbursements?

If you currently use Counsel for interim applications then it looks like the general rule will be that it ordinarily won't be covered. There will still be arguments around disbursements so long as they are reasonable, proportionate and justified but paying parties will make the case that any disbursements are already covered by the fixed costs amount and some Judges will no doubt be receptive to this. It is worth pausing and reflecting on the language here may as opposed to will or shall. The language appears to leave the door open for the court to allow other amounts. There may well be justifiable circumstances but presumably these will require a high threshold.

A good example might be where vulnerability is an issue. The Court of Appeal case of Santiago may afford some flexibility (costs must be viewed through the prism of access to justice). A translator involved in an interim application, for example, ought to be justifiable.

The reality is using Counsel on applications subject to fixed costs could create some difficult questions. There is no guarantee such costs would be allowed and it is likely such fees could exceed the fixed costs sum. In this scenario who is picking up the shortfall? Will legal representatives find a way to do the work at the fixed costs as the Master of the Rolls audaciously predicts? If not who is taking the hit? There are only two realistic answers - the legal representative or the client.

Strategies - On Paper? Remote? In-Person?

Practically then questions arise around strategy, applications by consent or on paper will be cheaper but not always practical. Can we expect an increase in this approach going forwards? The court can order a hearing even where parties agree one is not required and an on paper decision could be appealed and necessitate an oral hearing in any event! (more costs ... !)

For cases requiring oral hearings then they need to be remote. It's not particularly workable on a remote basis let alone on an in-person basis. The rules suggest no travel expenses would be allowed and the sums are realistically not going to cover preparation of the application, consideration of opponents response, preparing for hearing and advocacy, let alone throwing travel into the mix!

Reallocation & Reassignment a sting in the tail?

There are other considerations. Where a case is reallocated or reassigned in relation to costs it has retrospective effect. So what happens where a claim starts on the Multi-Track but later is reallocated or reassigned? There's a strong argument for solicitors to seek to get application costs summarily assessed to avoid the costs liability potentially getting reduced down the line. The flip side is also true what if your track or complexity band increases? If costs have been summarily assessed you could lose out on costs. Will this uncertainty see courts reluctant to undertake summary assessment preferring to defer the quantification (not the liability) of costs to the end?

Escaping Fixed Costs?

The only potential get outs, absent Multi-Track allocation (which means costs on a time basis) are exploring the exceptional circumstances test or the vulnerable parties test at the end of the case which could see sums exceeding FRC allowed. Summary assessment would likely curtail this and it's hard to envisage the court addressing costs already dealt with.

Pre-Action Applications - More problematic?

And Pre-Action applications are problematic where there are arguments between the parties over allocation or assignment. The Court may not just have an application to deal with but also have to devote time to the costs consequences. One cop out may be to order deferral of payment until the end of the case to avoid pre-allocation decisions about allocation/assignment. But if a case settles pre allocation these issues will still need resolving if not agreed.

Conclusions

So in short looking at the fixed costs how workable are they for you? Think of similar applications and the costs involved. Can you make it work?

And it's fair to say that on examination the rules around application costs leave open significant uncertainty both in approach and implementation. When the October reforms were thought up this lack of certainty cannot have been the intention. Satellite litigation once again beckons.

We are always happy to talk any aspect of costs! Should you have any queries arising from this blog or generally then please get in touch for a chat either via phone 01482 534567 or e-mail info@carterburnett.co.uk. Follow us on LinkedIn to keep up-to-date with developments.

Share this post: