Extension of Fixed Costs Explained

Posted on 21st April 2023 at 10:37

By Sean Linley, Senior Costs Draftsperson

The rules governing the extension to Fixed Recoverable Costs to most civil litigation cases with a value of up to £100,000.00 are now live.

Known as the Jackson Reforms, this new Fixed Costs regime is set to be implemented from 1 October 2023.

All of the key documents are available on the Judiciary website, but we have waded through the rules to summarise the key points.

Speed-Read - the Fixed Recoverable Costs regime at a glance

For those wanting to get to grasps quickly then the key takeaways are:

- Fixed Recoverable Costs will apply to most civil litigation claims with a value of up to £100,000.00 when new rules come in from 1 October 2023. When these rules apply will vary depending upon the kind of claim.

- They will apply to claims where proceedings are issued on or after 1 October 2023, save for Personal Injury claims (including Disease claims). For PI cases the extension of fixed recoverable costs applies where the cause of actions accrues on or after 1 October 2023, whilst for Disease cases will only apply to cases where a Letter of Claim has not been sent to the Defendant before 1 October 2023.

- There will be the introduction of an Intermediate Track. Fixed Recoverable Costs will apply to all claims allocated to this track. This will include some Clinical Negligence claims but only those where breach of duty & causation are admitted and they are allocated to the Intermediate Track.

- Clinical Negligence claims more generally will be subject to a separate Department of Health scheme. This has not yet been finalised but it is envisaged it will only cover claims with a value of up to £25,000.00.

- Complex claims with a value of under £100,000.00 may be allocated to the Multi-Track. Fixed recoverable costs will not apply to Multi-Track cases.

- There will be the introduction of complexity bands in the Fast and Intermediate Tracks. Depending on the complexity bands it will impact what level of fixed recoverable costs are claimable.

- Part 36 reforms will see indemnity costs replaced with a 35% uplift on the fixed costs for some cases.

- Disbursements will remain a battleground with a new section of Part 45 devoted to the subject. Broad scope to recover disbursements under the Intermediate Track so long as they are reasonable.

- The amount of fixed recoverable costs are set out in numerous tables under the new Part 45 Practice Direction.

What do the Fixed Recoverable Costs apply to? And what about Clinical Negligence?

Fixed Recoverable Costs will apply to most civil litigation claims with a value of up to £100,000.00.

Clinical Negligence will largely not be subject to these changes. This is because there is a separate fixed costs scheme which is to be implemented by the Department of Health. The full details of this are not yet known but the consultation suggests it will apply to Clinical Negligence claims with a value of up to £25,000.00, will contain multiple exceptions and will initially only apply pre-action. There is no firm date on the road map for Clinical Negligence claims so it is not known when such changes will be implemented or take effect.

We say they are largely not captured by the changes as if breach of duty & causation is admitted then a Clinical Negligence claim can be allocated to the new Intermediate Track. It is not wholly clear but it is presumed this would have to be full admissions and not simply partial admissions. If it was allocated to the Intermediate Track then the applicable fixed recoverable costs would apply.

What are the exceptions from FRC?

As above, the Court will have discretion to allocate complex cases with a value of under £100,000.00 to the Multi-Track exempting them from the extended fixed costs. The key question will be what is classed as a complex case? It is something that will no doubt be tested in the future.

There are, however, other notable exemptions and these will be set out in rule 26.9(10):

- Housing Claims – The implementation of FRC to such claims will be delayed for two years from October 2023. The cases will be allocated accordingly but will not be subject to FRC for the period of delay.

- Mesothelioma and other asbestos related lung disease claims.

- Clinical Negligence, unless both breach of duty & causation is admitted.

- A claim for damages in relation to harm, abuse or neglect of or by any children or vulnerable adults

- A claim that the court order to be tried by jury if satisfied there is in issue a matter set out in Section 66(3) of the County Courts Act 1984 or section 69(1) of the Senior Courts Act 1981.

- Claims against the police involving an intentional or reckless tort, or relief or remedy in relation to the Human Rights Act. The exclusion does not apply to an RTA arising negligent Police driving, an employer’s liability claim, or any claim for an accidental fall on Police premises.

- Aarhus Convention Claims remain subject to the same scheme as set out under Section VII of Part 45 (though it will be moved to Part 46 (Costs Special Cases)).

- Intellectual Property – The costs rules governing scale costs in the IPEC (currently Section IV of Part 45) will remain the same, though like Aarhus Convention Claims the rules will be moved to Section VII of Part 46.

The new Part 45 rules also make it clear that the fixed costs rules it sets out for Fast Track, Intermediate Track and Noise Induced Hearing Loss claims will not apply where a party is a Protected Party.

When do they apply?

They will apply to claims where proceedings are issued on or after 1 October 2023, save for Personal Injury claims (including Disease claims). For PI cases the extension of fixed recoverable costs applies where the cause of actions accrues on or after 1 October 2023, whilst for Disease cases will only apply to cases where a Letter of Claim has not been sent to the Defendant before 1 October 2023.

This means that there will be live cases now which will be caught up in the new fixed costs rules. It is vital to be across these and to understand what they may mean going forward for recoverability and profitability. This will impact clients who may face increased short-falls between the costs of bringing litigation and the costs which can be recovered. It will also impact Paying Parties in the terms of what costs may be paid out.

One of the key emphasis’ is that Judges will retain discretion to allocate more complex cases valued at under £100,000.00 the Multi-Track, so that complex cases will not be inappropriately caught up in the extended fixed costs scheme. It is fair to expect that Allocation Hearings will become a fraught battleground once more.

The Court will have the power in exceptional circumstances to reallocate a claim, potentially seeing a fixed costs claim move out of fixed costs entirely. As mentioned later in this article, exceptionality is a high threshold and reallocation can mean moving downwards as well as upwards. Practitioners will be pleased to know that the Court promises at least 7-days’ notice for an allocation or assignment hearing!

What is the Intermediate Track?

As part of the reforms there will be an introduction of a separate Intermediate Track. This will sit between the existing Fast and Multi-Track. The Fast-Track will remain as it is (i.e. claims up to £25,000.00) whilst less complex Multi-Track cases with a value under £100,000.00 damages will be allocated to a separate Intermediate Track.

It is envisaged that the new track will capture cases which can be tried in three days or less, with no more than two expert witnesses giving oral evidence on each side. It will also generally only apply to cases where the claim brought by one Claimant against no more than two Defendants or brought by no more than two Claimants against one Defendant. Crucially where a claim includes non-monetary relief it will not be allocated to the Intermediate Track unless the Court considers it to be in the interest of justice to do so. Any case more complex will be allocated to the Multi-Track where the extended fixed costs scheme will not apply.

The Intermediate Track will have four complexity bands (1 to 4) with associated grids of costs for the stages of a claim. The more complex the claim, the greater the fixed costs. As well as allocation hearings, claims may have assignment hearings which are as they say on the tin and will deal with the assignment of the relevant complexity band.

The new Intermediate Track will also have new standard directions.

There are some well-founded concerns and questions circulating online. What happens, for example, if you have a Clinical Negligence claim valued at less than £100,000.00 with three experts with no admissions until the Defence is served? The Defence is served and breach of duty & causation is admitted, meaning one of the experts falls away. You're then in a situation for allocation where the claim is suddenly suitable for the Intermediate Track. However, on issue it was clearly suitable for the Multi-Track. There is going to be uncertainty for parties during litigation as to what the recoverable costs will look like and under Part 26 allocation will be at the discretion of the Court. Is allocation prospective or retrospective? It appears this will turn on the Judge on the day. You can sense arguments on both sides but the notion of litigating with such uncertainty cannot be the Judiciary's intention? The difference here is significant, a Multi-Track case is not fixed costs whereas an Intermediate Track case is. It is a recipe for satellite litigation.

One notable observation under the IT is that there is no distinction for pre-issue and post-issue fixed costs. The first staging covers all work undertaken up to and including the sate of the service of the Defence. Is the intention here to put parties off issuing by diluting the fixed costs pot further or will this incentivise parties to issue sooner? For Defendants will they simply request a fully issued and pleaded case knowing that the fixed recoverable costs payable will in effect remain the same (recoverable disbursements would inevitably increase). This is juxtaposed with Fast Tack FRC which do have a distinction for pre-and-post issue costs.

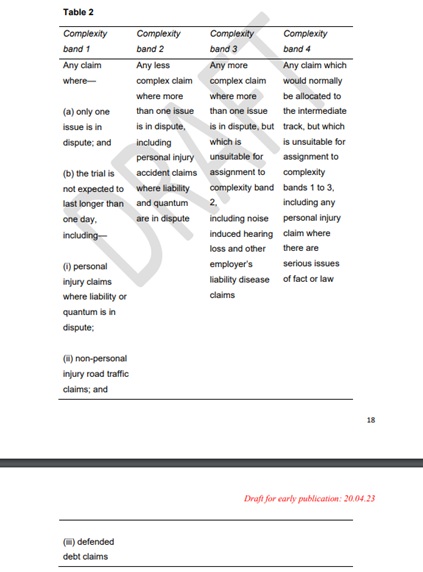

What are complexity bands?

Within the Fast Track and Intermediate Track, the Court will now also assign the claim to a complexity band (unless Section VIII of Part 45 applies (Noise Induced Hearing Loss)). The bands will act like a scale with those claims assigned a higher complexity band commensurate with higher fixed recoverable costs. The parties may agree a complexity band but the Court retains discretion to assign whatever band it sees appropriate. In the Directions Questionnaire parties will have to state whether there is an agreed complexity band and if not agreed set out a view on the appropriate band and why together with supporting information.

Clearly this will be a contentious area as it will directly impact not only upon the costs recoverable but the costs which are payable.

What is also important to note is that in exceptional circumstances the Court will be able to not only reallocate a claim but also reassign a claim. Clearly the use of exceptional here denotes that there will be a high threshold and it should be emphasised that reallocation and reassignment could as well be downwards as much as upwards.

The Fast Track complexity bands and Intermediate Track bands are set out as follows:

What is clear from these bands is that they are going to lead to disputes. The key question is going to be whether Defendants more readily and quickly concede aspects of the case in order to limit their adverse costs. The Judiciary’s hope, no doubt, will be that it encourages parties to settle cases earlier but it could have an adverse impact. If the adverse costs of going to Trial are fixed and known then parties may be more willing to go to Trial, the uncertainties of costs can sometimes bring pragmatism. It remains to be seen what the short, medium and long-term consequences will be.

The level of fixed costs for each complexity band are set out under Table 12 of the new Practice Direction for Part 45 for Fast Track and Table 14 for the Intermediate Track. They are far too numerous to set out here but it’s safe to say that the sums, for most cases, are less than what would have been recoverable had standard basis time costs applied.

What are the Fixed Costs?

The Judiciary were keen to stress that the fixed costs themselves have been uprated to reflect inflation. The MoJ have proposed to review these again in three years’ time and it is proposed it will include uprating for inflation in line with the SPPI.

The actual fixed recoverable costs are set out in the new Part 45 Practice Direction. The moving of the tables to the Practice Direction was a deliberate one as it will make them easier to update. The various tables can be found here.

For Intermediate Track cases the lowest rung of fixed recoverable costs (i.e. complexity band 1, settling pre-issue) would provide for £1,600.00 plus 3% of the damages plus VAT and disbursements. The permutations are numerous but for a claim on complexity band 4 which settles following a 1-Day at Trial with no approval, ADR or specialist advice from the legal representative, then the fixed costs would be around £36,200.00 plus 22% of the damages plus VAT and recoverable disbursements. The Intermediate Track has lots of additional fixed costs for matters like ADR, Approval (see below) and advice in writing or conference at various stages including after issue and following the service of the Defence. This will afford greater flexibility than for Fast Track claims.

One other notable point of interest is that there is no distinction for pre-and-post issue fixed costs. Stage 1 of the Intermediate Track covers all work undertaken up to and including the service of the Defence.

Disbursements and Specialist Legal Representatives – A battleground which will not go away

Disbursements will remain a hard-fought battleground. Those familiar with fixed costs already will be well aware of the satellite litigation that arises. Disbursements will have their own section in the new CPR 45 rules, highlighting just how expanded and complex this area is. With expanded fixed costs there are an increasing number of permutations for consideration. It would be impossible go through all of these here. Some notable observations are that interpreter and translator fees are explicitly recoverable. For the Intermediate Track the Court may allow any disbursement which has been reasonably inccurred, other than a disbursement covering work for which costs are already allowed. This is significant as it is much broader and less onerous than disbursement claims on the Fast Track.

There are some notable omissions too, no clarity is given on costs which may be covered by the fixed costs themselves, such as agency fees and for certain Counsel fees (i.e. should you get on an Intermediate Track claim Counsel’s fee for say settling the Particulars of Claim and the fixed costs for that stage?). The answer to this is a likely no, Table 14 has sums for a specialist legal representative to provide post-issue advice in writing or in conference or drafting a statement of case as well as advice post-Defence. It’s likely the fixed recoverable costs will be a catch-all for such work irrespective of who does it. There is also no clarity on the fee remission point and the recoverability of Court Fees where no remission is investigated. On that particular point ensuring there is a file note setting out that relevant considerations have been given remains the best practice. Legal Representative is defined under CPR r2.3 as a barrister, solicitor, solicitor's employee, manager of a body recognised under Section 9 of the Administration of Justice Act 1985 or a person authorised for the purposes of the Legal Services Act 2007. This is an important detail as in principle, the specialist legal representative providing post-issue advice in writing or conference or drafting a statement of case OR advising in writing or conference following the filing of a Defence could be any of the described individuals. It appears to allow a claim, in principle, for a solicitor to have the fixed recoverable costs at the relevant staging plus the ancillary fixed sums. It's likely arguments will still persist, as they do now, about precisely what the FRC covers and whether, for example, elements of work undertaken by Counsel or a Medical Agency are already covered by the FRC amount.

The wording of S2 states it is an additional fixed amount for a "specialist legal representative providing post-issue advice in writing or in conference or drafting a statement of case". S1 covers all work undertaken from Pre-Issue up to and including the date of the service of the Defence. The wording of S2 is unclear but we take it to mean either post-issue advice or drafting a statement of case i.e. the drafting of a statement of case could, in principle, be pre-issue, despite the fact that S1 covers all work up to the Defence. It could be an area open for interpretation but we cannot foresee how the intention would be for an additional sum to draft a statement of case only after issue.

Turning to ADR in Intermediate Track claims then there are fixed recoverable costs for this of £1,200.00 plus VAT. This is the same irrespective of the Complexity Band. There is also an additional sum allowable for say Counsel or another specialist legal representative (see above) which ranges from £1,400.00 plus VAT for Complexity Band 1 up to £2,300.00 plus VAT for Complexity Band 4. So the Judiciary consider increased remuneration for specialist legal representatives as complexity increases but for solicitors, irrespective of complexity you are stuck with £1,200.00 plus VAT. These fees are fixed so it will not matter what the length of ADR is, there will be some winners but plenty more losers.

One other detail around Fast Track, is that additional disbursements will be permissible for a Fast Track claim which is assigned to Complexity Band 4. CPR r45.46 allows for a post-issue advice in writing or conference, fixed at £1,000.00 plus VAT and/or drafting a statement of case fixed at £500.00 plus VAT. Notably, the Court may only order payment for one advice in writing or in conference unless further advice is justified. No examples are given of what justification might look like but parties will have the opportunity to test this at Court as an interim application which itself will subject to fixed costs!

Can I still make a claim for costs exceeding fixed costs?

The answer is yes, parties can still make applications for costs greater than the fixed recoverable costs where there are exceptional circumstances. We have previously reported on some decisions where such applications were successful (example 1 / example 2)

What about non-monetary claims?

It is acknowledged that most FRC claims will be for damages. It has been agreed for that non-monetary claims will be fixed assign values for individual bands and that in mixed claims (those with monetary and non-monetary relief) the fixed costs will be calculated by the two parts taken together.

That said the new CPR r26.9(8) provides that where the relief sought includes a claim for non-monetary relief then it will not be allocated to the Intermediate Track unless the court considers it to be in the best interests of justice to do so.

The values assigned are as follows:

Band 1 – N/A (as non-monetary relief will not apply in these cases)

Band 2 – £10,000.00

Band 3 - £15,000.00

Band 4 - £20,000.00

For the Intermediate Track it will be:

Band 1- £25,000.00

Band 2 - £50,000.00

Band 3 - £75,000.00

Band 4 - £100,000.00.

The Judiciary have accepted that the intermediate track should generally only be for monetary claims but can be applied in exceptional circumstances in order to limit adverse costs or to save the parties from “ruinous litigation.”

What about claims involving multiple Claimants? Will I get fixed costs for each Claimant?

Generally you will be entitled to separate fixed costs for each Claimant where there are multiple Claimants all represented by the same lawyer. They are, however, some exceptions:

- Where the claim is for a remedy to which the Claimants are jointly entitled; and they are joined to the proceedings to comply with CPR r19.3; or

- Where the court orders that additional claimants are each entitled only to 25% of the principal Claimant’s FRC plus recoverable disbursements. The Court may only make such an order if it considers it is in the interest of justice to do so and must have regard to whether the claim of each claimant arises from the same or substantially the same facts and gives rise to the same or substantially the same issues.

This issue should be considered and determined by the Court at allocation or assignment (see CPR r26.7(9)).

Vulnerability and Approval

Disappointingly, the Government does not propose to make any changes to the arrangements for disbursements for vulnerability in FRC cases. This will leave open concerns and questions surrounding access to justice for those who most acutely need such protections. There are some rule changes at CPR r45.10. This will allow the Court to consider a claim for an amount of costs above the fixed recoverable costs though it has some stipulations in place.

Firstly, a party or witness has to be vulnerable, secondly that vulnerability has to have generated additional work and thirdly that the additional work alone must exceed a sum greater than 20% of the fixed recoverable costs. To be blunt here, this is a lot of work for a Practitioner to undertake and quantify where that quantification could be challenged and an additional sum may not even be allowed (and in fact the Court could allow a lower sum!). It is one of the most disappointing and concerning aspects of the reforms.

On the Intermediate Track there are additional fixed costs allowed for the approval of settlement for children, this varies depending on the assignment of complexity band but ranges from £1,200.00 up to £2,000.00 plus VAT. Practitioners will have to be aware of this as it may not be cost effective for both Counsel and the legal representative to conduct an approval hearing.

If vulnerability drives additional work and the system to be remunerated for this work is cumbersome then some Practitioners may elect to avoid representation of vulnerable parties. At best it will likely see the erosion in the quality of legal services for vulnerable parties. Preserving good quality access to justice for vulnerable parties should be paramount and the Judiciary must keep a close eye on the impacts of changes for vulnerabilities and act quickly if negative impacts transpire.

A reminder as previously mentioned the new Part 45 rules also make it clear that the fixed costs rules it sets out for Fast Track, Intermediate Track and Noise Induced Hearing Loss claims will not apply where a party is a Protected Party.

Counterclaims

Two sets of FRC are recoverable where a party is successful in defending a claim and in bringing a counterclaim. There are exceptions to this. Where the only remedy sought by the counterclaim is a defence then there will be no costs of the counterclaim or where in a claim to which the RTA protocol applies there is a counterclaim which does include a claim for personal injuries. With the latter, any order for costs will be equivalent to one half of the applicable Type A and Type B costs in Table 11.

Pre-Action and Interim Applications

The rules neatly deal with the issue of pre-issue and interim applications with the Court confirming that any party who obtains a costs order will be entitled to the costs set out in Table 1, together with the appropriate court fee. Application costs (exc. court fees) will vary from £250.00 plus VAT up to £750.00 plus VAT.

What happens where there is a Preliminary Issue Trial?

Where FRC applies and there is a Preliminary Issue Trial , the costs of any preliminary issue trial are recoverable separately. The rules governing Preliminary Issue trials can be found at CPR 45.48 for the Fast Track and CPR 45.51 for the Intermediate Track. Parties will be entitled to additional fixed recoverable costs if a claim continues after a Preliminary Issue Trial.

Part 36 gets some bite in Fixed Costs cases

The writer has long loathed the situation in fixed costs matters where a Claimant could beat its Part 36 offer and it have next to no impact on costs. There will now be a more punitive scheme in place. This is set out in Sections II and III of the updated Part 36.

For certain Fixed Costs cases indemnity costs awards are out and in truth given indemnity costs had next to no bite anyway it is sensible to do away with it. Instead additional costs equivalent to 35% of the difference between the fixed costs for the stage applicable when the relevant period expires and the stage applicable at the date of judgment. Get your calculators ready!

The 35% uplift will apply to claims where Section VI (Fixed Costs in the Fast Track), Section VII (Fixed Costs in the Intermediate Track) and Section VIII (Claims for Noise Induced Hearing Loss) apply. There will be some tedious considerations as to precisely what applies in each claim but some punitive impact is no bad thing. Will it be enough of a deterrent and whether it is fair remuneration are questions left for another day.

If a Part 36 offer is beaten at Trial by a Claimant, then the Defendant will have to pay enhanced interest on the fixed costs payable at a rate not exceeding 10% above base rate.

Unreasonable Behaviour has Consequences

A Paying Party can apply to the Court where the Receiving Party has acted unreasonably. The Court has the power to reduce the fixed recoverable costs payable to an amount equivalent to 50%. On the flip side a Receiving Party can apply to have the fixed recoverable costs uplifted by 50%.

The rules define unreasonable behaviour as “conduct for which there is no reasonable explanation.”

Restoration Proceedings

It is pleasing to see that for claims on the NIHL cases and where Restoration Proceedings are required to restore a Defendant company to the Companies Register and the claim is ultimately successful, the fixed costs may include the sum of £1,280.00 plus VAT and applicable disbursements.

Litigants in Person

The extension to FRC is relevant to Litigants too and what they may recover. Where a party is a Litigant in Person throughout a claim, the costs allowed cannot exceed two-thirds of the fixed recoverable costs which would be allowed under the relevant section. Disbursements will be recoverable pursuant to the relevant sub-section of the rules and will not be limited. The full detail is set out in CPR r45.4.

Practical Advice

The best advice at this stage is to be ready. Make sure you know the key dates for changes and act accordingly to reasonably protect your position. Make sure you check your client care and retainer documents so that they address the changes to include the recovery of costs from your client above the fixed recoverable costs.

Be wary of offers from opposing parties and scrutinise any costs terms. Even where the new rules do not technically apply, you could inadvertently contract into them. If in doubt, check the offer/proposed order with a costs specialist before it is accepted or agreed.

Make sure where the new rules do apply, you are recovering everything you are entitled to. The expansion of the rules makes it more important than ever as margins will be reduced. Moreover, the permutations are now more numerous and complex so it would be easy to overlook something.

Make sure you know your case from the outset, the allocation and assignment hearings are going to be pivotal in not only determining whether a case is fixed costs but also what level of fixed costs are recoverable. Do not sell your cases short!

Be mindful of what disbursements are and are not recoverable and the challenges you may face. You can plan to mitigate this because any short-fall will otherwise potentially come out of your fixed costs.

Finally, remember this is new for everyone with newness comes inevitable teething issues and parties seeking to exploit opaque areas. There will be uncertainty but by familiarising yourself and asking questions where you’re unsure you will put yourself in the strongest possible position.

The short, medium and long-term impacts are all unknowns and there will be strong opinions on all sides. Right now we have to face the reforms head-on and make the best of them as we can. Those making these decisions though need to be aware of the impacts on legal representation and the quality of it and most importantly upon access to justice. If negative consequences arise then there will need to accountability and a willingness to change and adapt the rules as time goes on.

Do you need help or advice about the 2023 Jackson Reforms?

If you want to have a chat about the Jackson Reforms or you have a specific question, give us a call on 01482 534567 or email info@carterburnett.co.uk - we'll be happy to have a friendly discussion.

Share this post: