Final Report on the SCCO Guideline Hourly Rates

Posted on 2nd August 2021 at 09:26

By Sean Linley, Costs Draftsman

The final report on the SCCO Guideline Hourly Rates has been published by the Civil Justice Council. To be clear these are the final recommendations of the CJC and it is for the Master of the Rolls and the CJC as a whole to consider whether to accept the recommendations. The report does send a clear message that Guideline Hourly Rates should increase. In this post we examine the key findings arising out of the CJC final report.

The Recommended Rates

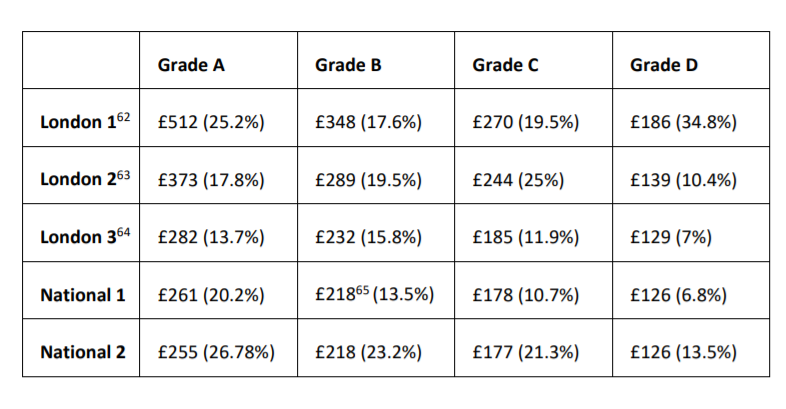

Let's get straight into the headline information. What hourly rates are proposed? The CJC recommended that the rates proposed in the previous interim report are those which should be adopted.

What can be gleamed is that increases across the board have been recommended which will be welcome news to receiving parties. Unsurprisingly, paying parties had argued that no increase was justified and in some cases, should even be reduced.

The CJC made it clear that there is not an inevitable correlation between value and complexity of case and cited clinical negligence as an example. It was added that it 'may be appropriate' for an hourly rate in excess of the GHR depending upon how 'substantial and complex' the litigation is.

They also made clear within the final report that "GHRs are not, and cannot be, prescriptive to judges." They are nothing more than a starting point on assessment.

National 3 is removed, streamlining the GHRs so it is merged with National 2. The counties of Kent, East & West Sussex and Surrey are recommended to become Band 1 counties. Existing Band 1 counties and other identified Band 1 centres will remain in Band 1. All other areas will be / will remain Band 2. Concerns about competitiveness and fairness, particular with reference to the higher London rates were dismissed by the working party.

On the issue of having one National rate, the working party stated that there may be a case for this in the future but there was not sufficient information or evidence to undertake such a change now.

The working party have recommended more regular reviews of the GHRs, proposing a further review in 3 years with the GHRs updated annually in line with an appropriate SPPI index. The latter is something been considered in the context of fixed costs as well.

Concerns have been raised that an annual increase would cause complexities with Budgets, Bills and N260s. The working party, however, said that they felt it "is a lesser evil than permitting GHRs to stagnate, particularly given that there is the possibility of somewhat higher inflation, following the pandemic ..."

London rates

An interesting observation in the context of London rates is a shift to define London 1 by the nature of the work, rather than by geographical location. The CJC final report proposing that London 1 be restricted to 'very heavy commercial and corporate work'. Notably, one SCCO Master expressed concerns that this would lead to arguments about what fell into this description; the working group, however, did not share this concern.

What this does mean is that London 1 is open to any centrally based London firm and is no longer restricted to a particular postcode.

An error in the current GHRs will see the London Borough of Kingston upon Thames moved from Band 1 to London 3.

The relevance of where the work is undertaken

The Covid-19 pandemic has seen a rise in remote working and this is something which has persisted even as restrictions ease. The working party were clear that it was impossible to assess the impact of the pandemic upon over-heads. It does, however, frame an interesting recommendation made within the final report. In the interim report, proposals were made as to the possibility of practitioners certifying where work was undertaken. Concerns were raised by respondents as to the practicalities of this and it is easy to see the long and winding path which could be opened. Should a London firm recover London rates if the work was undertaken from home, in say a National 1 area?

The final report offers up some reassuring clarity on the recommendation. The proposed intention is to identify the location of the fee earner by reference to which office they are predominately attached. It is not intended to cover work done from home. The working party did say, however, that this was something which may need to be considered in further reviews.

Practically, it means that if a file is transferred between offices then you could see different rates applied, this could see delegation potentially move beyond fee earners but also to geographical boundaries. Obviously this will not be open to all firms but it will be interesting to see how future reviews deal with the point, particularly with an expansion of remote working looking like it will stay in place for the foreseeable future.

The working party has recommended that the N260 should be amended to expressly identify the geographical band and grade of each fee earner. It is likely if implemented this will be extended to Bills of Costs as well. For cases run out of and by one office this is unlikely to have any practical impact.

Other details

Some other details embedded within the report include a recommendation that the hourly for a Litigant in Person should be considered in light of the final report. The current rate is £19.00 per hour, having been previously been increased from £18.00 per hour on 1 April 2015.

The SCCO Guide is proposed to be revised to reflect that barristers' rates "should be allowed at the grade which best reflects the length of their litigation experience". This deals with the issue whereby Grade A and Grade B only referred to Solicitors and Legal Executives and recognises the increase in the employment of barristers within solicitors' practices.

One area of disappointment for Costs Practitioner's is the working party declining to consider an increase to the provisional assessment cap on costs which currently stands at £1,500.00 plus VAT and any Court fees. The working party stated that this is a matter for the Civil Procedure Rule Committee. What is clear is that if GHRs are increasing then this ought to be reflected in the PA cap, else fee earners are in essence, expected to do the same amount of work but in less time.

Conclusion

The final recommendations will no doubt be cautiously welcomed by receiving parties, though, there will be those who would have wished for further increases. The proposed annual inflationary reviews are a move to be welcomed but the report leaves us with many questions which will only be borne out through the passage of time. Will remote working cause a medium-to-long term effect? Is it time to streamline the GHRs to one National Band?

The working group have made clear that if the proposed GHRs are introduced, they should be applicable to all summary assessments from the date of their introduction. Moreover, they have said that the proposed GHRs should be guided by the outcome of the reviews of Fixed Recoverable Costs and IPEC capped costs.

It's unclear as to when any recommendations will be considered / approved but the CPRC have previously intimated that they are keen to see this progressed swiftly. It is not unrealistic that changes may be made before the end of the year, though, any timescales could be impacted by the FRC and IPEC capped costs reviews. As always, we will keep any changes under review and share any updates once known.

Tagged as: Hourly Rates

Share this post: